Specialized tax prep for professionals in Massachusetts

Specialized returns for RSUs, ISOs, crypto, multi-state income, rental

property, and pass-through K-1s — built for tech, biotech, and startup professionals.

Serving clients across Massachusetts — including Cambridge, Brookline, Lexington, Arlington,

Newton, Somerville, Milton, Wellesley, and beyond. Designed for dual-income households,

startup exits, year-end planning, and complex state or investment reporting.

Tax Services

Most clients fall into one or two categories based on how they earn, invest, or move.

Below are the most common drivers of tax complexity.

Massachusetts Equity Compensation Tax Specialist

RSUs · ISOs · ESPPs

RSU withholding is often 22% federally. Your actual tax rate is usually much higher.Returns prepared with full equity compensation modeling and Massachusetts-specific analysis.

Massachusetts-based Enrolled Agent

Focused on equity comp, crypto, and multi-state returns

Secure digital filing

Transparent pricing

This is for you if any of these are true:

You received a Form 3921 but don’t know if AMT applies

Your W-2 includes RSU income but withholding feels low

You exercised ISOs or sold company stock in the past 12–18 months

You’re approaching a startup exit and haven’t modeled taxes yet

⚠ RSUs withheld at 22% but taxed at higher marginal rates

⚠ Massachusetts under-withholding on equity income

⚠ Cost basis mismatches between Form 3921 and 1099-B

⚠ AMT exposure after ISO exercise

Crypto & DeFi

Trades · Staking · Airdrops · NFTs · DeFi activity

We reconcile wallet and exchange data, track cost basis, and prepare IRS Form 8949 and staking income reports.

This is for you if:

You had 50+ trades this year

You’ve used staking, yield farming, or DeFi platforms

You received tokens via airdrops or forks

You moved assets across wallets or exchanges

⚠ Missing or incorrect cost basis across wallets

⚠ Staking and airdrop income misreported or omitted

⚠ Transfers flagged as disposals

⚠ DeFi activity not matching Form 8949 totals

Remote & Multi-State

W-2 splits · Part-year residency · State sourcing

We handle part-year and non-resident returns, credit claims, and residency analysis for multi-state taxpayers.

This is for you if:

You moved during the year (e.g. NY → MA or MA → NH)

You live in a no-tax state but work for a MA employer

Your RSUs or bonus vested in a different state

⚠ Income taxed by the wrong state

⚠ Missing or incorrect resident credits

⚠ RSUs sourced to the wrong work state

⚠ Remote work triggering unexpected filings

Pricing

Pricing reflects the scope and complexity — not just a form count. Returns are prepared with strategic treatment,

audit-ready documentation, and full reconciliation of equity, crypto, and multi-state issues.

Pricing reflects the scope and complexity — not just a form count. Returns are prepared with strategic treatment, audit-ready documentation, and full reconciliation of equity, crypto, and multi-state issues.

Single-State W-2

Starting at $400

Includes:

Federal + 1 state return

Equity Comp

Starting at $850

Includes:

RSUs, ISOs, AMT, Form 8949, QSBS

Crypto / DeFi

Starting at $1,250

Includes:

Form 8949, staking, reconciliation

Multi-State Filing

Starting at $845

Includes:

Part-year or nonresident + sourcing

Add-ons: 83(b) election filing ($350), K-1 income from partnerships or trusts (from $1,500), rental property income (from $1,100).

Quotes are tailored after a brief consult.

How It Works

01. Initial consult

We check for fit and outline your needs.

02. Digital intake

You upload tax forms and background info.

03. Review

Screen share or recorded walkthrough.

04. Final delivery

Return filed electronically, documents stored securely.

All returns are prepared using IRS-authorized software.

Communication is paperless, secure, and designed to minimize back-and-forth.

About Alti Tax

Alti Tax is a Massachusetts-based tax practice focused on complex individual situations, including equity compensation, real estate, consulting or side income, and multi-state filings.

The practice is run by Jukka Heikka, a licensed Enrolled Agent who works directly with clients and brings a background in technology, startups, and investing. That perspective informs how RSUs, ISOs, stock sales, and other high-impact tax events are handled in practice.

Returns are prepared carefully and reviewed with attention to detail. Clients value clear explanations, responsiveness, and confidence that their situation has been considered end to end.

Schedule a 15-Minute Tax Review

Early booking encouraged for January–April deadlines.

Year-End Tax Moves for Equity, Crypto, and Remote Work

There’s still time to act before December 31 — but not much.

If 2025 brought any financial changes — like selling stock, exercising options, moving across state lines, or realizing crypto gains — you may still have ways to reduce what you owe. But many tax strategies have strict year-end deadlines.

Common Triggers That Warrant Action Now:

Stock option exercises or RSU vesting: AMT exposure, 83(b) timing, basis tracking — all time-sensitive.

Significant crypto gains or losses: Loss harvesting and accurate 8949 filing depend on correct year-end treatment.

Moved states or worked remotely across borders: Split residency, income sourcing, and tax credits all require advance planning.

Secondary sales or startup exit: QSBS eligibility, installment treatment, and timing of recognition can impact liability.

Capital gains from investments: Harvesting losses, estimated tax adjustments, and donation strategies are on the table.

Talk Before You File

A short, focused consult can surface savings, reduce surprises, and help you finish the year with a clear plan.

✅ Free 15-minute consult

✅ No prep needed — just bring your questions

✅ Clear, actionable insight — fast

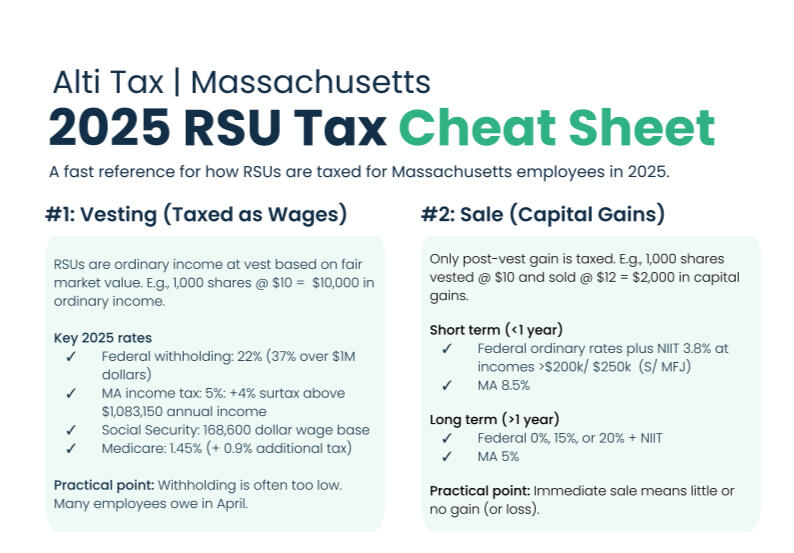

2025 RSU Tax Cheat Sheet for Massachusetts Residents

There’s still time to act before December 31 — but not much.

RSUs create ordinary income at vest, which often pushes withholding below the required levels. Many employees discover this only at tax time. Everyone should know few essentials about RSUs.

How Are RSUs Taxed?

Vesting is treated as wages based on fair market value

Sales only create capital gains on the amount above the vest price

Immediate sale usually results in little or no gain

Key 2025 Tax Rates

Federal payroll withholding on RSUs is 22 percent, or 37 percent over 1M

Actual tax owed is often higher than payroll withholding because it depends on your total income

Massachusetts tax is 5 percent plus a 4 percent surtax above $1,083,150

Social Security wage base is $168,600

Medicare is 1.45 percent with an additional 0.9 percent for higher

Talk Before Year End

A short, focused consult can surface savings, reduce surprises, and help you finish the year with a clear plan.

✅ Free 15-minute consult

✅ No prep needed — just bring your questions

✅ Clear, actionable insight — fast

Legal & Privacy

1. Privacy Policy

We collect and use personal and financial data only as needed to prepare accurate tax filings and related services. This may include:

• Identity and contact information

• Income, asset, and tax data

• W-2s, 1099s, K-1s, and other documentation

• Communications and intake materials

We do not sell or share your data for marketing or unrelated purposes.

Security Measures

We follow the IRS’s Safeguards Rule for tax return preparers, including a written Data Security Plan as required under IRS Publication 4557. This includes:

• Limited access to client information

• Secure storage of electronic documents

• Use of encrypted tools for file transfers and document handling

• Risk-based review of systems and procedures

We use third-party tools for document uploads, scheduling, and communication. These providers meet standard encryption and security expectations for tax professionals.

2. Terms of Service

Engaging services through this site or via direct agreement constitutes acceptance of these terms:

• Services are provided on a best-effort, professional basis, guided by the information you provide.

• You remain responsible for timely submission of your tax-related data and documents.

• Work begins after a signed engagement agreement and payment (or payment arrangement).

• Filing deadlines are not guaranteed unless expressly confirmed in writing.

• Fees are subject to adjustment if the scope of work changes materially.

We reserve the right to decline service if conflicts, timing, or regulatory concerns arise.